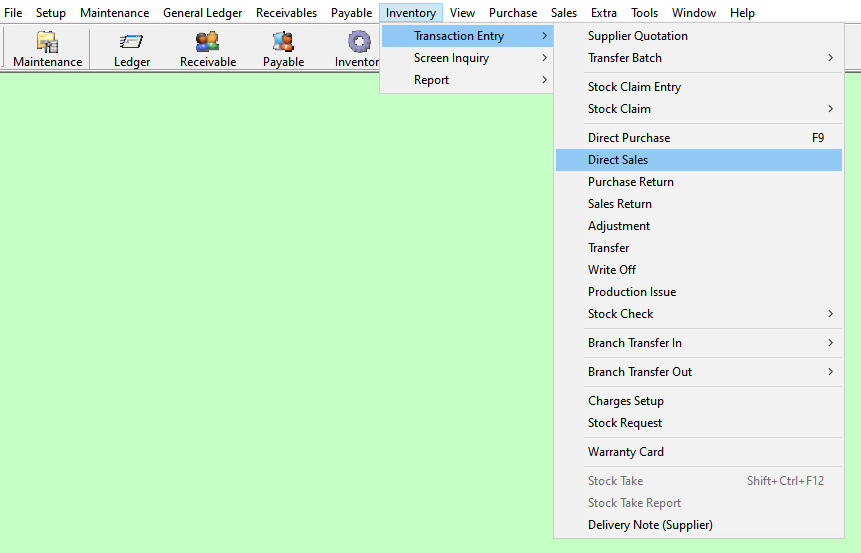

5.1.6 Direct Sales

⬝ Inventory > Transaction Entry > Direct Sales

This entry is used to add a direct sales document. A direct sales document is created when there is a sales and the stock in the inventory needs to be deducted.

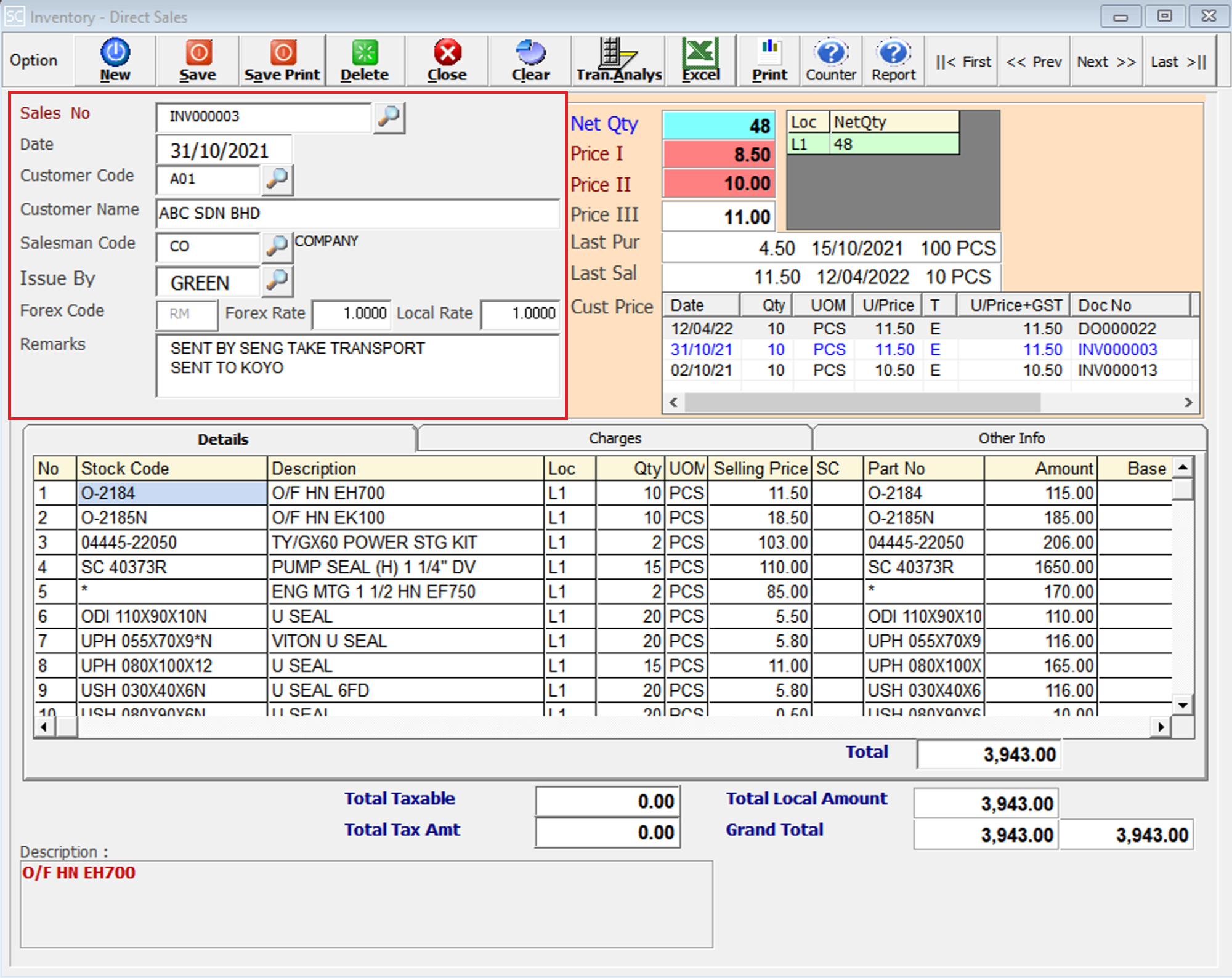

Click on the “telescope” or press F2 for a list of existing documents.

Eg. Sales No: INV000003

The date will default follow computer date.

Eg. Date: 31/10/2021

Directly type the Customer name or customer code to search. You can also click on the “telescope” or press F2 for a list of Customer that had been maintain earlier.

Eg. Customer: A01

After entering the customer code, the customer name will automatically display based on customer master entry (F8).

Eg. Customer Name: ABC SDN BHD

After entering the customer code, the salesman code will automatically display based on the customer master entry (F8). You can also click on the “telescope” or press F2 to select a different salesman code.

Eg. Salesman: CO

Select the issuing person for this entry.

Eg. Issue By: GREEN

This will follow your customer master entry (F8) forex code setup. You can also click on the “telescope” or press F2 to select a forex code.

Eg. Forex Code: RM

Is the rate at which one currency can be exchanged for another. It determines how much of one currency you can get for a given amount of another currency.

Eg. Forex Rate: 1.0000

Refers to the exchange rate provided by a specific financial institution or business for currency conversion within a particular locality or country.

Eg. Local Rate: 1.0000

Additional remarks can insert as a reference.

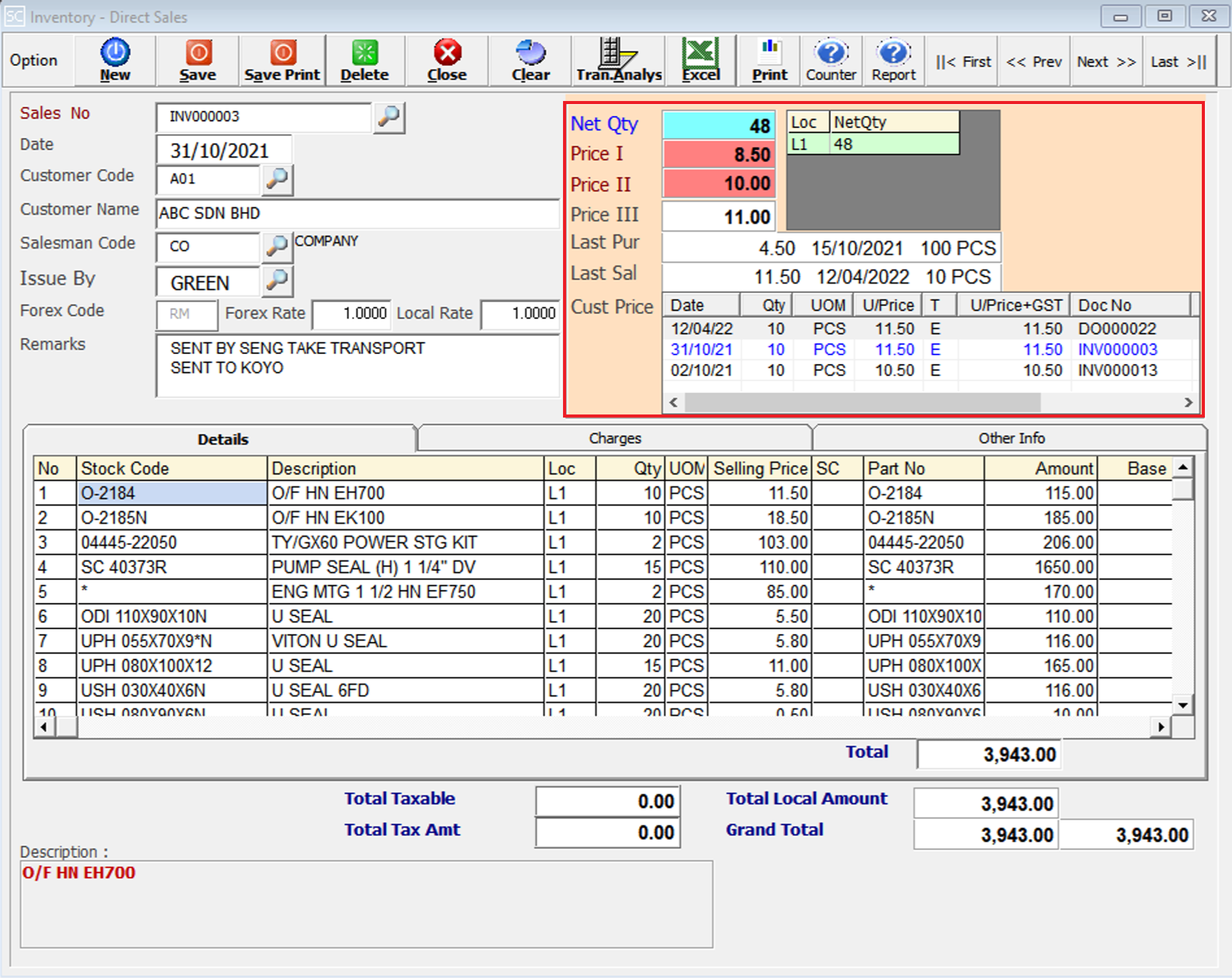

Net Quantity. The total quantity available of this item selected.

It displays the location quantity.

After entering the stock code, the selling Price I will automatically display based on stock master entry (F7).

After entering the stock code, the selling Price II will automatically display based on stock master entry (F7).

After entering the stock code, the selling Price III will automatically display based on stock master entry (F7).

This shows the last transaction purchase cost, purchase date, and purchase quantity for the stock item.

This shows the last transaction sales price, sales date, and sales quantity for the stock item.

This shows the latest 3 transaction sales for the customer we select for the stock item.

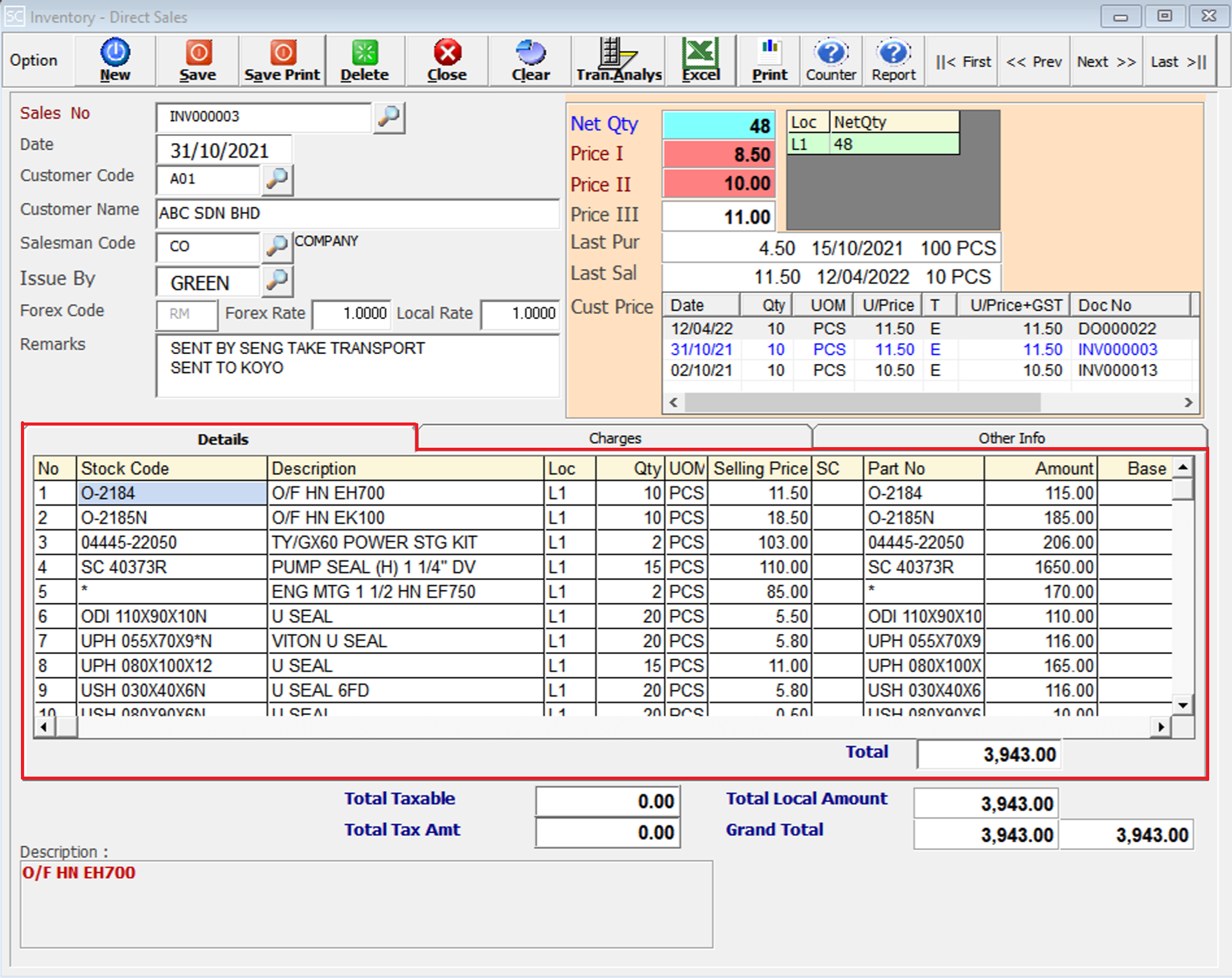

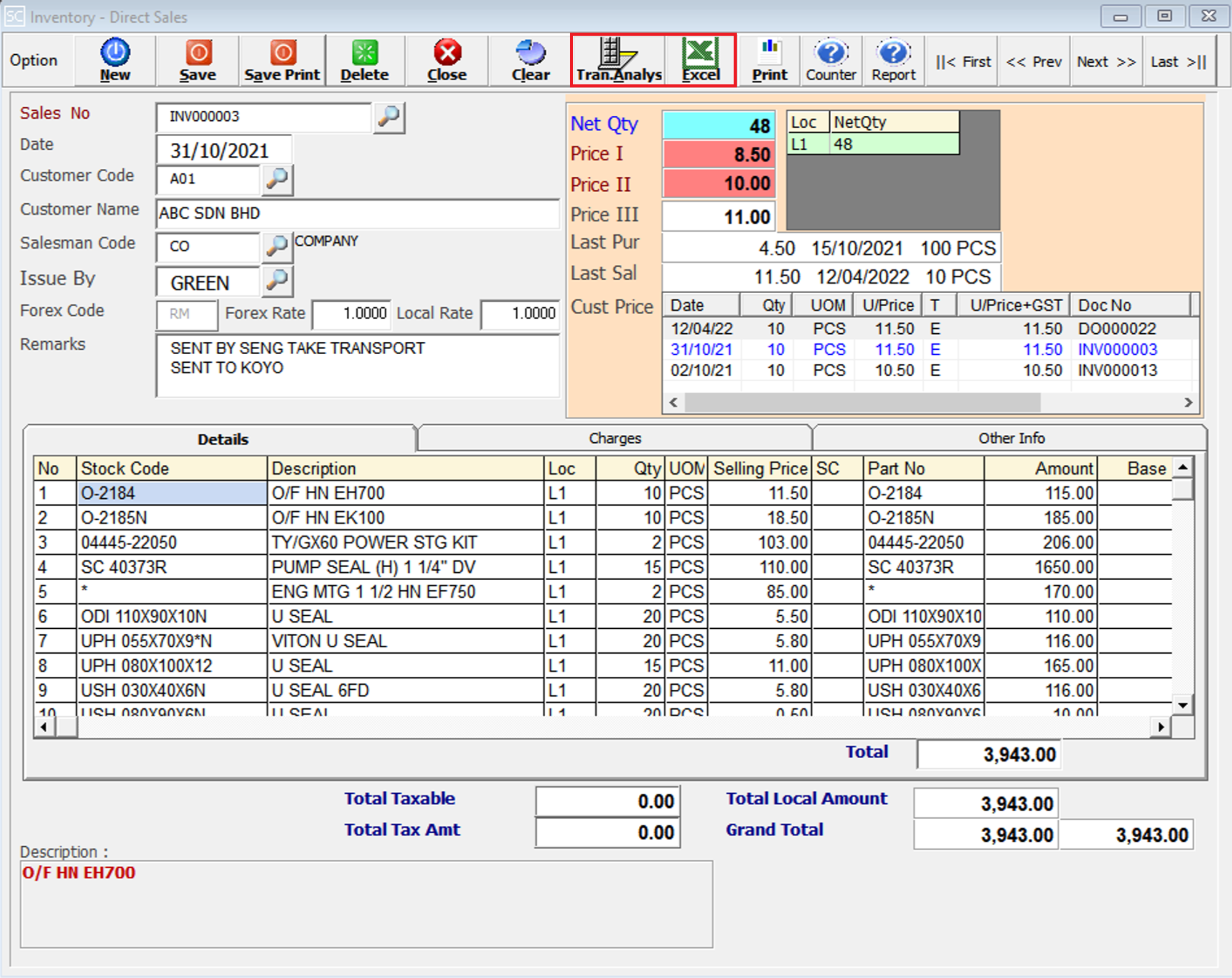

Enter the stock code. Item entered in this field must exist in the stock master entry (F7). You can also click on the “telescope” or press F2 for a list of valid stock items. Stock code (*) can be used to enter a non-stock item.

Eg. Stock Code: O-2184

A default description that had been pre-maintained in the stock master entry (F7) will appear on the screen. This description also can be modified.

Eg. Description: O/F HN EH700

Enter the location code where the stock item is issued. You can also click on the “telescope” or press F2 for a list of pre-maintained location codes.

Eg. Loc: L1

This is the quantity of stock item.

This is the Unit Of Measure for the stock item. The system will default from the UOM pre-maintained in the stock master entry (F7).

Eg. UOM: SET, PCS, CTS, KGS

This is the amount for one stock item. Enter the unit price for the current stock item.

Eg. Selling Price: 11.50

This column is specified such as the offer or indent.

This column you can put another part no to show to the customer. The part no column for printing will be taken from this column.

This is the total amount for the stock item (Qty x Unit Price).

The final total amount of the transaction.

Eg. Total: 3,943.00

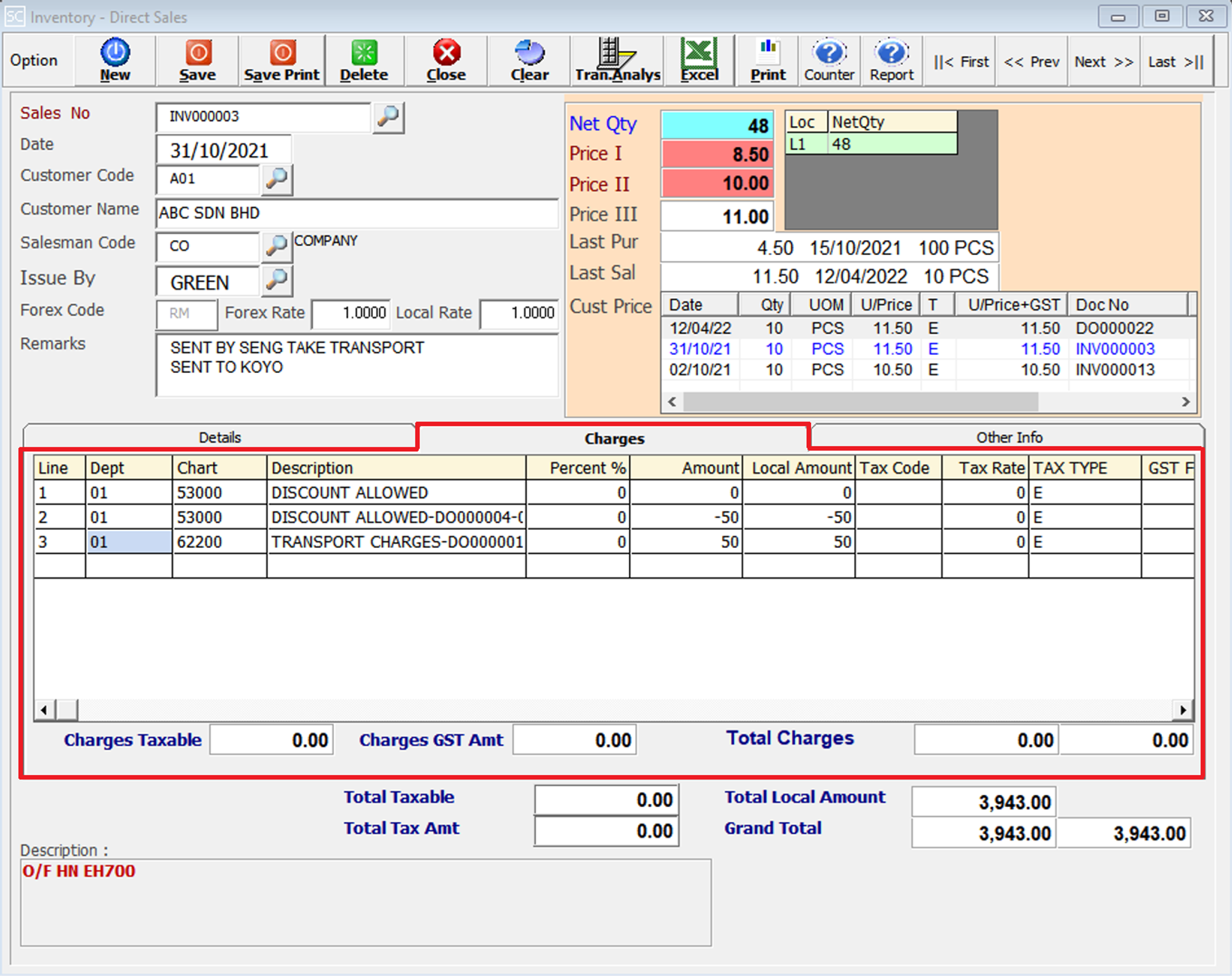

After entering the Invoice Details, you can add any additional charges, such as discounts allowed or transport charges, if applicable.

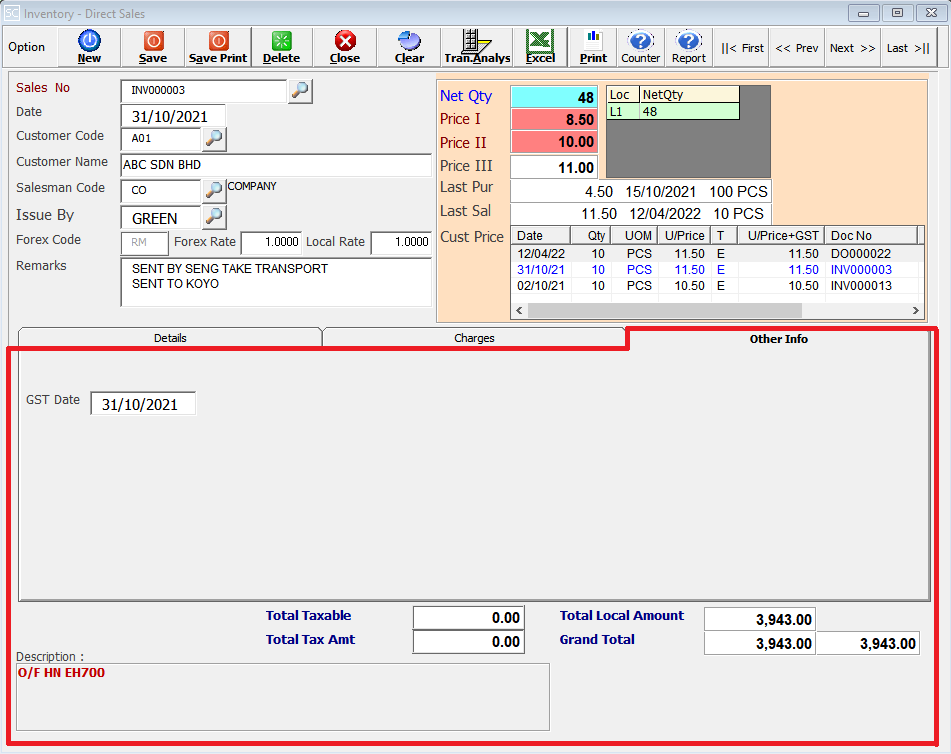

The date of when the GST expires.

The total amount of taxable items in the transaction.

The total tax amount calculated for the taxable items.

The subtotal of the transaction before tax and rounding adjustments.

The final total amount of the transaction, including tax and rounding adjustments.

Description will automatically display as on stock master entry (F7).

This is to view the detail in/out transaction for the stock item we selected.

This is for import & export the bill to & from Excel File.